Best Digital Banks in Canada: Compare the Options - 2026

As we manage more and more of our lives on the move, digital banks are becoming increasingly popular in Canada and worldwide. Digital banks can offer some great features, such as zero fees for certain transactions, managing your funds from the comfort of your phone, and much more.

But, with so much choice out there, which digital bank is best?

In this article we'll cover what you need to know about opening a digital account, including the best options already in the Canadian market and some of the most convenient international providers like Wise and OFX.

Table of content

What is a digital account?

A digital bank is an institution that does not offer face-to-face service. They are also called virtual banks or online banks.

Digital banks usually don’t have any branch network - instead they offer practical solutions to avoid traditional banking bureaucracy, as well as the possibility of managing your funds from the convenience of your phone or computer.

Digital accounts have varied features and fees - but can be especially helpful if you travel often or plan to move abroad. In this case, a digital bank from an international specialist can help you with currency conversion and overseas spending, to make sure you’ve always got the currency or currencies you need, whether you’re at home or abroad.

Are digital banks safe?

Reputable digital banks and alternative account providers are usually regulated in much the same way a regular bank would be - making them safe to use.

Some digital banks have full Canadian banking licences, and are CIDC members.

Other providers like Wise may not hold a full banking licence, but are registered with FINTRAC as money service businesses instead. This may mean that providers like these can’t offer the same range of services that a fully fledged bank can - but it does mean they should be just as safe for the services they do offer.

As digital banks are online and mobile first businesses, they tend to have easy to use websites and apps which come with all the latest in security technology, so you can rest easy knowing your money is in safe hands.

Best digital accounts available

You’re spoiled for choice in Canada, when it comes to digital account options. You’ll be able to choose a local Canadian digital only bank, a digital service from a traditional bank, or an international digital bank, depending on what suits your needs. Here are a few examples - and we’ll look at a few in more detail in just a moment:

Digital banks in Canada: Tangerine, EQ Bank, Wealthsimple

Digital banks from traditional banks and financial institutions: Simplii, Manulife, plus digital banking services embedded in other large Canadian banks such as Scotiabank and RBC

The best digital account for you will depend on your specific preferences and needs. However, to help you see some differences between different account types, let’s look at an overview of some of the most popular accounts from digital banks and providers in Canada.

We’ll highlight one bank or provider from each of our three categories above as an example.

| Wise | Tangerine | Simplii | |

|---|---|---|---|

| Opening fee | No fee | No fee | No fee |

| Maintenance fee | No fee, no minimum balance | No fee, no minimum balance | No fee, no minimum balance |

| Card available | Available | Available | Available |

| Possibility to hold multiple currencies | Hold 50+ currencies and exchange with the Google exchange rate | Checking accounts are CAD only Savings accounts are available in USD | Checking accounts are CAD only Savings accounts are available in USD |

| Business account | Available | Available | Not available |

| Other services available | Send payments to 80+ countries, get local bank details to receive fee free payments from 10 countries | Credit cards, investments, mortgages, loans and credit services | Credit cards, investments, mortgages, loans and credit services |

| Advantages | Multi-currency account for day to day use at home and abroad | Broad range of banking solutions all from one provider | Full range of services - plus you can deposit cash at a CIMB ABM |

| Disadvantages | Some service fees apply, depending on how you use your account | No international transfer service | Fees apply to transactions, based on how you use your account |

*Tangerine account profiled is the Tangerine Checking Account; Simplii account profiled is the Fee Free Checking account - other account products are available, which have their own features and fees

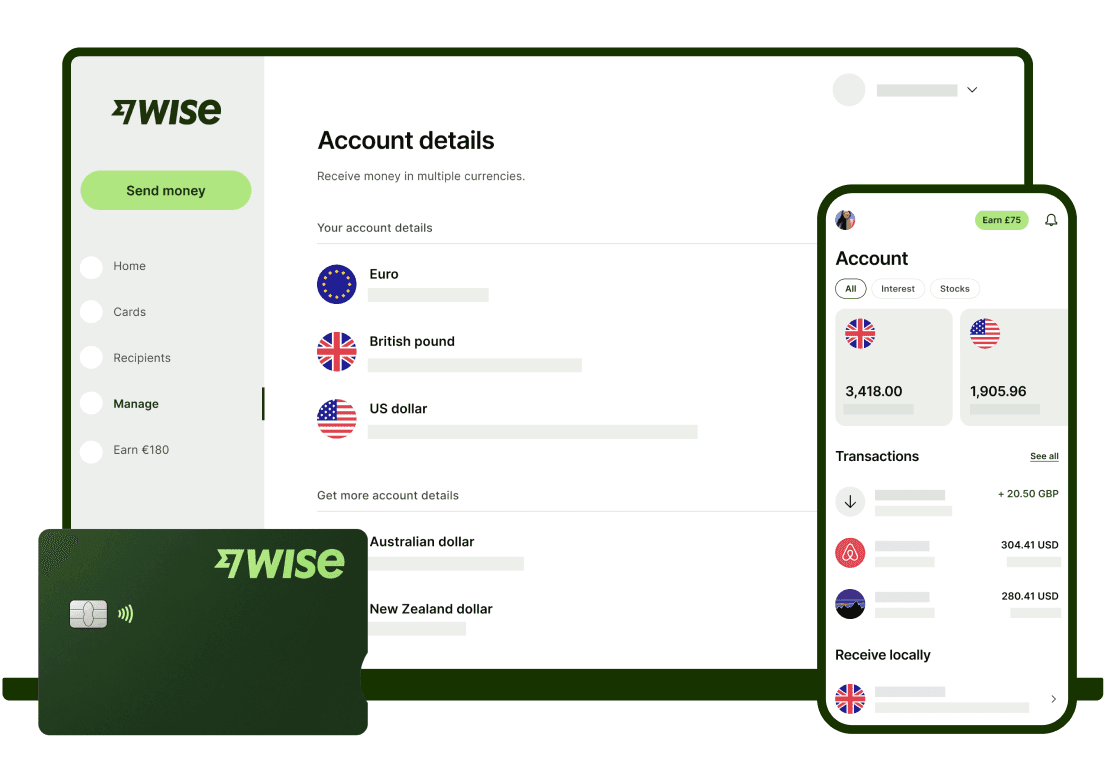

Wise

Wise is available in almost all countries around the world, with multi-currency accounts you can open online or in-app. Hold and exchange 50+ currencies, and get local bank details to get paid for free from 30+ currencies. You’ll also be able to order a linked debit card which can be used to spend all over the world.

Wise is available in almost all countries around the world, with multi-currency accounts you can open online or in-app. Hold and exchange 50+ currencies, and get local bank details to get paid for free from 30+ currencies. You’ll also be able to order a linked debit card which can be used to spend all over the world.

One big advantage of Wise is that all currency exchange uses the mid-market rate, with conversion fees from 0.41%. That can mean you save compared to other banks, as there’s no foreign transaction fee to worry about.

Account types: Accounts available for personal and business customers

Eligibility: Open from Canada or using your normal ID and proof of address from your home country - broad range of countries supported

Fees: No fee to open a personal account, currency exchange from 0.41%, some fee free ATM withdrawals every month

Safety: Globally regulated in all regions of operation

Read a complete Wise review here

Tangerine

Tangerine is a popular Canadian digital bank which has an excellent selection of products and services, from checking and savings accounts, loans and mortgages, credit cards, investments and more. Checking accounts can be opened online if you’re a Canadian resident with eligible ID, and aged over 16. You’ll then be able to get a linked debit or credit card, for easy spending.

Account types: Broad range of accounts, including checking and savings - plus a full selection of other financial services like credit, loans, mortgages and investments

Eligibility: Checking accounts available to Canadian residents, aged 16 or older

Fees: Checking accounts have no fees to open or maintain, daily transactions are free. However, there are out of network ABM fees, and you’ll pay a 2.5% foreign transaction fee

Safety: Fully licensed and safe provider to use

Simplii

Simplii is the digital banking division of CIBC, and therefore has a full banking licence - and a great range of products and services. You can open a Simplii no fee checking account, in CAD, to manage your money day to day, and get a linked payment card for easy spending and withdrawals. Other products include credit cards and loans - and you can also send global payments easily, although fees may apply for this service.

Account types: Broad range of accounts, including checking and savings - plus a full selection of other financial services like credit, loans, mortgages and investments

Eligibility: Canadian residents only

Fees: checking accounts have no fee to open or maintain, and no minimum balance. However, transaction fees apply, including a 30 CAD fee for international wires

Safety: Fully licensed and safe provider to use

What are the advantages of a digital account?

As we get more and more used to using our phones and smart devices to organise life, it’s no surprise that an increasing amount of people opt for a digital bank instead of traditional banks. With a digital bank you’ll be able to manage your money on the move with just your phone, including checking balances and transactions, sending payments, and even switching between currencies if you have a digital bank with multi-currency features.

Here are some of the key advantages of a digital account, to help you decide if one is right for you:

Open an account online or in an app - with less paperwork compared to a normal bank, and automated verification processes

You can manage your account and make transactions online or via an app, so you’re never out of touch with your money

Some digital banks and providers offer faster international transfers with better exchange rates and lower fees compared to normal bank wires

Specialist providers allow you to manage multiple currencies within one account, to switch between them and receive payments from overseas

You can find international digital account providers which use the mid-market exchange rate, to cut the costs of transfers, payments, and other international services

With a digital bank you’ll never need to stand in line in a bank branch again

How to choose the right digital account for your needs

There’s no single best digital account - each bank and provider has its own account types which are aimed at different customer needs. That means you’re sure to find one that suits you - but you may need to do a bit of research to make sure you’re picking the perfect option. Here are some things to consider:

Currencies available: Some specialist digital account providers let you hold and exchange multiple currencies, which can cut the costs of travel and overseas spending

Fees and charges: Many accounts have no monthly fee to pay, but transaction fees will still apply in some circumstances - check out the fee schedule carefully to make sure you know what to expect

Debit or credit card available: For convenience, pick a bank or provider which offers a card for easy spending and withdrawals

Security: Choose a reputable provider which is properly regulated for the services it offers, to be on the safe side

Ease of use: Finally, check the provider’s app is easy to use - and make sure you know what happens if something goes wrong. How can you talk to customer service and get support?

Types of digital accounts

We’ve already seen that there are quite a few different types of digital accounts available, including some accounts which offer specific features that can make them especially well suited to some customers. Here are a few different types of digital accounts you may consider.

Digital accounts for investments

Canada has a few specific online account providers for investments, such as Nest Wealth and Wealthsimple. You might want to buy and trade stocks, ETFs or crypto - or get managed portfolios, which could have lower fees compared to traditional brokerage services.

Best digital account to keep money in other currencies

Some digital banks and account providers have great multi-currency functionality, including the options to hold and exchange dozens of global currencies all in one place. Wise is a great example, with 50+ supported currencies, and exchange which uses the Google rate. You’ll just pay a low, transparent fee when you switch between currencies in your account, spend internationally, or send an overseas payment - from 0.41%. Wise also offers a linked payment card, and local bank details for up to 10 currencies, so you can get paid for free.

Digital bank with credit or debit card

A lot of the digital banks and providers we’ve profiled in this guide offer linked debit cards or credit cards, which can make life much more convenient for spending and withdrawing. Pick a checking account from a Canadian digital bank - or if you’re planning to travel and shop online in foreign currencies, take a look at Wise as a flexible digital account with low cost access to currency conversion.

How to open a digital account

The exact steps you need to take to open a digital bank can vary based on the specific bank - and whether you’re looking at a Canadian digital bank, or a global provider like Wise.

Canadian bank:

If you’re signing up for an account with a Canadian bank like Tangerine or EQ Bank, you’ll usually need to take the following steps:

Download the bank’s app or head to the desktop site

Select the account you’re interested in and click Join now

Enter your name and contact information and create a secure password

Follow the online prompts to add your verification details, including a copy of your identity and address documents, and your Canadian Social Insurance Number

Verification may be done automatically, or may take a day or two

Money transfer provider:

If you pick a global provider like Wise you’ll need to take the following steps to open an account:

Download the Wise app or open the desktop site

Click Sign up and create an account using your Facebook, Google or Apple ID

Upload images of your ID and address document - address does not need to be Canadian

Verification may be done automatically, or may take a day or two

To open a digital account you’ll usually need the following documents:

Proof of identity - like a passport or driving licence

Proof of address - for some banks this must be a Canadian address

You may also be asked for your Social Insurance Number and a local phone number.

What you need to know before opening a digital account

Let’s look at a few things to think about before choosing a digital bank.

Do digital banks apply taxes?

Tax is a complex area, and exactly how your digital bank may work will vary depending on your location, the account type and your personal situation. Reach out to your own bank directly to get all the details you need.

How to withdraw money from a digital bank?

Many digital banks offer linked debit cards you can use to spend and make cash withdrawals, and also the option to make online transfers to your own accounts, or another account held at a different institution.

How to deposit money in a digital account?

Deposit money in your digital account by Interac transfer or wire, or have someone send you a payment. Some banks also let you deposit checks - including mobile check deposit - or cash, if the bank also has an ATM network.

What is the eligibility for a digital account?

Most of the digital banks in Canada we have featured require you meet the following conditions to open an account:

You must be a Canadian resident

You’ll need to be over 16 or 18 for a full account service

You’ll be asked to provide your Social Insurance Number

You’ll need a local phone number

Global providers may be a bit more flexible, accepting a proof of residence address from other countries - which can be helpful if you’re new in Canada and don’t have bills in your name yet.

Conclusion

Opening an account in a digital bank has big advantages, including flexible services you can access on the move, and low fees. Nowadays, there are many options to choose from, including local and global banks and providers. That means with a bit of research you'll definitely find the Canadian digital account to suit your needs. Use this guide to kickstart your hunt - and don’t forget to look at a good selection of options including digital accounts from local banks, and specialist non-bank alternatives.

FAQs - Best digital banks in Canada

A digital bank has no physical branch network, so you’ll transact online or through an app. Many digital banks have full banking licences and can offer the same services your normal bank might - but often with lower fees.

Open a digital account online or through an app, by signing up and uploading your personal identification and verification documents. Providers have a fully digital onboarding process for convenience.

If you want a digital account which can offer flexible international services, you may look at alternatives to digital banks, like Wise. Digital banks in Canada may not offer multi-currency functions, and may charge foreign transaction fees when you’re abroad. Specialist providers like Wisse can be a good way to save on foreign currency spending.

There’s no single best bank to keep money in. All of the providers we’ve looked at here are regulated for the services they offer - making them safe to use. Start with our top picks, and see which suits your needs.