How to Send Money with a Credit Card: A Full Guide 2026

If you need to get money to someone quickly, using a specialist money transfer service, and choosing a card to pay for your transfer can be one of the quickest ways to go.

Specialist services can often provide fast, flexible transfers, which may also have better exchange rates and more transparent fees compared to using your bank. However, paying with a credit card can be one of the most costly ways to pay when sending money overseas - usually involving paying a relatively high transfer fee, and a cash advance charge to your own card issuer.

If you need to send a payment overseas with a credit card, it’s worth comparing a few different providers to make sure you get the best balance of speed, convenience and cost. Services like Wise or Remitly all have fast transfer options you can fund with a credit card - with fees and charges that can be more straightforward than those used by a bank.

Table of content:

- Can you send money abroad with a credit card?

- Apps to send money with a credit card

- How to transfer money from a credit card to a bank account

- Alternatives to credit card for paying international transfers

Can you send money abroad with a credit card?

Yes. With specialist online and in-app services, you can fund international transfers with a credit card. Different money transfer services have their own features and fees, so comparing a few is essential to pick the right one for you. For example, Wise uses the mid-market exchange rate when converting money, with super speedy delivery times - while Remitly can offer cash collection services if you want the recipient to get their money in person.

We’ll cover more detail on how these providers work when you send money abroad with a credit card, next.

When you might want to use a credit card to send money

Sending money with a credit card can be a costly option - and as providers usually use a percentage fee, it can be particularly pricey if you have to send a large amount of money. However, it does still have some advantages. Here are some occasions on which you might prefer it:

Emergencies: If you have an emergency and need to get money to someone fast, you may find using a card - including credit and debit cards - is the quickest option available. This is especially relevant if you’re sending a payment to someone who can’t easily access a bank. In this case, specialist services like Remitly and Western Union can help you make a transfer to someone which can be picked up in cash.

Reward Points: You may also consider using your credit card for more frequent transactions if you’re earning rewards or cashback on your spending. Before you decide to use your credit card to send a payment in order to earn rewards, double check you’ll actually earn points on your payment - and weigh up the extra costs you’ll need to pay against the benefit of the extra rewards.

Pros and cons of sending money overseas with a credit card

| Pros of sending money with a credit card | Cons of sending money with a credit card |

|---|---|

|

|

Apps to send money with a credit card

One of the easiest - and often cheapest - ways to send money with a credit card is to use a specialist money transfer app. Not all money transfer services can accept credit card payments, so it is worth comparing a few to see which offers the services you need.

We’ve picked out a few providers which do usually let you arrange a transfer with a credit card from Canada, and also highlighted a couple of other options just in case you’re considering alternative payment methods as well.

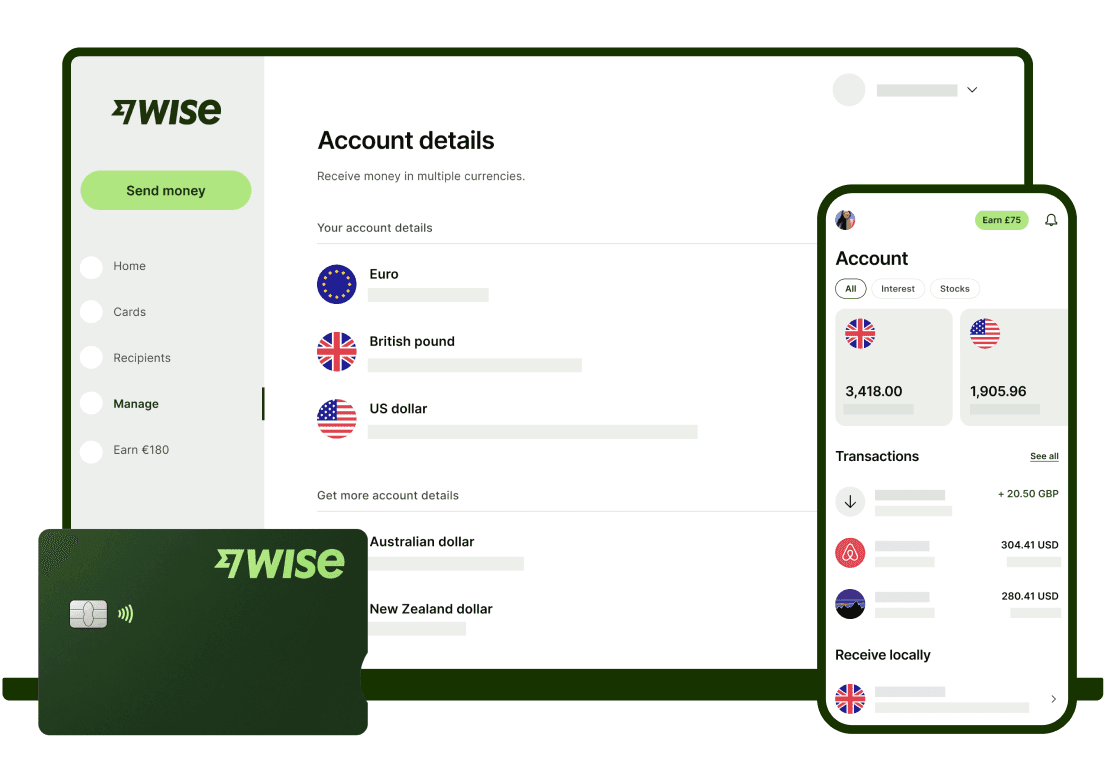

Wise

Wise is known as a low cost international transfer service which uses the Google exchange rate for converting currencies. Wise transfers arrive quickly into the recipient’s bank account - and can be instant if you’re paying by card. With your credit card, you can send payments to 80+ countries - and the good news is that Visa, Mastercard and some Maestro credit and debit cards are usually accepted for transfers from Canada.

Wise also offers fast transfers which you can fund by direct debit, Interac or wire - using one of these payment methods may be cheaper overall compared to paying with a credit card, but no matter how you pay, you’ll know you’re getting the Google exchange rate which can drive down the costs of currency conversion.

Click Here to Read a Full Wise Review [current-year]

Ready to go?

Remitly

Remitly transfers can be arranged online or through the Remitly app for convenience - and come with a great range of payout options. You’ll be able to choose to have your money sent to a bank or mobile money account, or collected in cash at an agent location - although it’s good to know that the exact options and services available do vary based on the destination country.

Remitly can accept Visa and Mastercard credit, debit or prepaid cards, and some Interac cards for payments from Canada. Card payments usually arrive in minutes. If you’d prefer you can often get a slightly lower fee - and a longer wait for delivery - by paying by bank transfer instead.

Click Here to Read a Full Remitly Review [current-year]

Ready to go?

WorldRemit

From Canada you can use WorldRemit to send payments funded by credit cards - or choose debit or prepaid cards, Apple Pay or Interac if you’d prefer. Delivery options vary based on where you’re sending to, but can include bank deposits and cash collection. Many WorldRemit payments arrive pretty much instantly, and you’ll see a delivery estimate in the app or on the desktop site before you confirm your transfer.

Click Here to Read a Full Remitly Review [current-year]

Ready to go?

Looking for something different? If you can use an alternative payment method, like a bank transfer, you may also be able to use these services:

OFX

OFX can’t usually support credit card payments, but may be worth considering if you have alternative ways to pay such as bank transfer. OFX supports transfers in 50+ currencies, and has a 24/7 phone service, which sets them apart from many other providers. You can always talk through your payment options by phone before you get started - which can be reassuring if you’re sending a higher value transfer.

TorFX

TorFX is another popular solution if you’re sending a payment overseas and can pay using a bank transfer. TorFX gets good customer reviews based on service, and also offers customer support online, in app and by phone.

How to send money internationally with credit card

Let’s walk through how to send a payment overseas with a credit card, using one of the specialist providers we’ve profiled above:

Pick your preferred online money transfer provider and register an account online or in the provider’s app

Set up your transfer by entering the payment amount, currency and recipient’s details

Select the option to pay by credit card - check everything over and confirm when you’re ready

Don’t forget, your own credit card issuer might charge a fee when you send a payment. Check your card’s terms and conditions before you start, so there are no surprises.

Using a credit card to transfer money domestically

Some providers also let you pay for domestic transfers using a credit card - but this service isn’t always available. Here are a few options you might consider if you need to send a payment within Canada, paid for using a credit card:

Western Union

Send payments locally within Canada, and pay online using your credit card. You can have the money deposited into the recipient’s bank account, or collected in cash.

PayPal

PayPal also lets you transfer funds locally using a credit card. However, while it’s free to send a domestic payment when you pay with your PayPal balance or linked bank account, there are fees to pay when you use a card. These are usually 2.9% plus a small fixed fee.

How to transfer money from a credit card to a bank account

You can send money from a credit card to a bank account in a few different ways - although not all card issuers will support all options. Here are some to consider:

Use a specialist money transfer app, like Wise, WorldRemit or Remitly, and select bank deposit as the delivery method

Get a cash advance by making a withdrawal from an ATM, and deposit the funds into your bank account

Arrange a bank wire directly from your credit card - this is not always possible, so you’ll need to check with your card issuer directly

Generally, transferring money from a credit card to a bank account can be pretty costly, so it’s probably not something you’ll want to do frequently. We’ll look at the likely fees, next.

How much does it cost to send money overseas using your credit card?

Sending money overseas with a credit card can be an expensive affair - and include more than one cost to think about. Depending on the card you use, and how you set up your payment, you may pay the following fees:

Provider’s transfer fee - this can be higher for a credit card payment compared to using a bank transfer or debit card

Exchange rate markup - paid to the transfer service, often about 3% of the transfer amount

Recipient bank fees - further fees may be deducted by the recipient’s bank if you send for bank deposit

Cash advance fee to your credit card issuer - often a fixed amount or percentage fee of around 3% - 5%, detailed in your card terms and conditions

Interest to your credit card issuer - may start to accrue immediately once you get a cash advance or make a payment

Comparing International Transfer Fees

Let’s take a quick example to show the differences in cost you might run into when sending an international credit card payment. In this example, we’re sending 1,000 CAD to a friend in the US, paid for using a credit card.

| Provider | Fee | Exchange rate | Recipient gets |

| Wise | 34.15 CAD | Mid-market rate | 701.75 USD |

| PayPal | 2.99 CAD | Exchange rate includes a markup | 695.51 USD |

| WorldRemit | 3.99 CAD | Exchange rate includes a markup | 695.22 USD |

As you can see, in this comparison, the recipient gets more when you make your credit card payment with Wise. That’s because Wise uses the mid-market exchange rate - the one you find on Google - with no markup, and splits out all the costs so you can see them clearly. That’s more transparent, and in this case, cheaper too.

Comparing Domestic Transfer Fees

Here’s a quick look at the fees you may find when sending local CAD payments with a credit card:

Western Union: No fee when you pay with card

PayPal: 2.9% fee + small fixed fee when you pay with card

Are the fees worth it?

As we’ve seen most of the providers available for sending transfers abroad charge extra fees for using credit cards. Card payments are fast and convenient - but if you’re trying to manage your costs, there are probably cheaper alternatives out there, such as paying by debit card or bank transfer.

How long does it take to send money with a credit card?

If you’re sending a credit card payment you’ll often find it arrives instantly in the destination bank account - or that it’s available for instant collection if you’ve arranged for the recipient to get their money in cash. Most providers have a delivery estimate available before you confirm your transfer, so you’ll be able to review and compare before you pay.

Alternatives to credit card for paying international transfers

If you don’t absolutely have to use a credit card you’ll probably find that there are cheaper, and better ways of sending money abroad. Here are some to consider:

Wire transfer - Fast way to move money domestically and internationally, although bank wire fees for overseas payments can be high

Interac or local bank transfer - Send money locally or internationally for a lower fee, with a specialist provider

Debit card - often one of the cheapest options to send payments with a specialist, which can result in a fast, or even instant transfer wherever you need your money to go

Conclusion

Transferring money from a credit card can be easy and fast, but the high fees involved will make this an option most people want to reserve for emergencies. If you need a more cost-effective method, you might want to consider cheaper alternatives, like paying by bank transfer or debit card.

That said, if you are looking to send money internationally and pay using a credit card, Wise, WorldRemit and Remitly are worth comparing, for speedy transfers, good exchange rates and lower fees compared to many banks.