Visa Foreign Transaction Fees & Alternatives for International Travel

If you plan to use a debit or credit card for international payments, you'll want to know about the additional costs which can be involved. Visa is a great pick for an international card as it's widely accepted around the world. However, some additional fees including foreign transaction fees and ATM charges can apply.

In Canada, Visa issues credit cards through banks like CIBC and RBC, and also has debit cards from popular banks like Scotiabank and TD Bank.

This guide walks through how Visa international card fees work with some popular debit cards, and also touches on alternatives such as Wise and Koho which may help you lower the costs of transacting by card overseas.

Visa international fees: Quick summary

| Questions | Answers |

|---|---|

| How much does Visa charge for international payments? | The costs of spending with Visa overseas depend on the bank your card is issued by. Costs can include a foreign transaction fee which may be about 2.5%, and overseas ATM charges of up to 7 CAD. |

| Can I use my Visa card abroad when travelling? | Yes. Visa is a very widely accepted card network globally. Use your card wherever you see the Visa logo, but be aware of any extra card payment fees before you travel. |

| Are there debit cards with no foreign transaction fees? | Some debit card issuers like Wise and Koho focus on making international payments as cheap as possible. Wise has no foreign transaction fee, while Koho waives foreign transaction fees on some plan types. |

Does Visa charge foreign transaction fees?

Visa is a card network which operates internationally to help facilitate payments and cash withdrawals. Visa issues cards in Canada through major banks and alternative specialist providers. Visa foreign transaction fees can apply, which are set by the bank or card provider, and which can vary depending on the type of account and card you select.

Can I use my Visa card internationally?

Yes. Visa is a very widely accepted card network globally. Use your card wherever you see the Visa logo, in stores, restaurants and ATMs.

Using a card to pay and withdraw overseas is secure and convenient, but you'll need to be aware of any extra card payment fees which may apply. Check out your account fee schedule before you travel, looking out for foreign transaction fees, currency conversion costs, and overseas ATM charges in particular.

We'll explain how foreign Visa card use works in depth in this guide - and we'll also give some pointers on how to avoid these fees to keep your spending low when you travel.

How does Visa compare on international fees?

Visa issues cards through Canadian banks and also in partnership with specialist account providers. The fees which apply to cards can vary widely. Whether you have a credit or debit card can be important, as well as the specific account you choose.

Here we've highlighted 2 Visa debit cards from major banks in Canada to give a flavour of the fees you pay, and also taken a look at alternatives like Wise and Koho which can help lower your overseas costs. We dive into a more close analysis of these Visa alternatives, and a few more, a bit later on.

| Provider | Monthly fee | Foreign transaction fee | ATM fee | Exchange rates |

|---|---|---|---|---|

| ScotiaCard Visa debit card | 3.95 CAD - 30.95 CAD for everyday accounts and packages | No foreign transaction fee | 3 CAD - 7.5 CAD depending on the location and the ATM operator | Visa rate |

| CIBC Advantage Debit Card | 16.95 CAD - 29.95 CAD for everyday chequing accounts | 2.5% | 2 CAD - 5 CAD depending on the location and the ATM operator | Visa rate |

| Wise Debit Card | No ongoing fees | None | 2 withdrawals to 350 CAD/month with no Wise fee, then 1.5 CAD + 1.75% | Mid-market rate + low conversion fee from 0.48% |

| Koho Mastercard Debit Card | 0 CAD - 22 CAD/month | 1.5% on Essential Plan, waived on other plans | Some plans offer no fee withdrawals | Mastercard rate |

*Details correct at time of research - 3rd March 2025

As you can see, the way different card providers work - including their costs for local and overseas use - can vary a lot. This means that weighing up your options, and selecting the right card or cards based on your specific spending patterns is important. This will allow you to limit the fees you pay to transact, and do more with your money.

Visa foreign transaction fees

Foreign transaction fees are percentage fees charged for transactions made in currencies other than CAD. These fees apply when you spend during an overseas vacation, if you make a cash withdrawal overseas, and if you spend online with an international retailer. If you're taking out cash abroad, the foreign transaction fee applies in addition to any ATM withdrawal fee you pay.

Here's a reminder of the foreign transaction fees for the cards we looked at earlier. We have a few other options you may want to consider as Visa alternatives coming up a little later.

| Provider | Foreign transaction fee |

|---|---|

| ScotiaCard Visa debit card | No foreign transaction fee |

| CIBC Advantage Debit Card | 2.5% |

| Wise Debit Card | No foreign transaction fee |

| Koho Mastercard Debit Card | 1.5% on Essential Plan, waived on other plans |

*Details correct at time of research - 3rd March 2025

The foreign transaction fee you pay with a Visa debit card, or a card from a specialist, is decided by the card provider rather than Visa directly. The fee applies to every transaction you make overseas or in a foreign currency. This means the foreign transaction fee can vary a lot. Even though the percentages look quite low, they build up very quickly, and can make overseas spending more costly than you expect.

Visa exchange rates

Visa sets its exchange rate with reference to wholesale market rates. This means that when you spend, the Visa rate you get may not be the same as you see online or with a currency converter.

Generally, the Visa rate is relatively fair. It may include a small fee, but the bigger issue is the foreign transaction fee your bank may add. If your bank or card provider has a foreign transaction fee, this can push up the amount you spend by 2% - 3% every time you transact.

Make sure you know what to expect when you sign up for a card - and if your bank has high foreign transaction fees, you may decide it's worth getting a specific low cost international card for your overseas use.

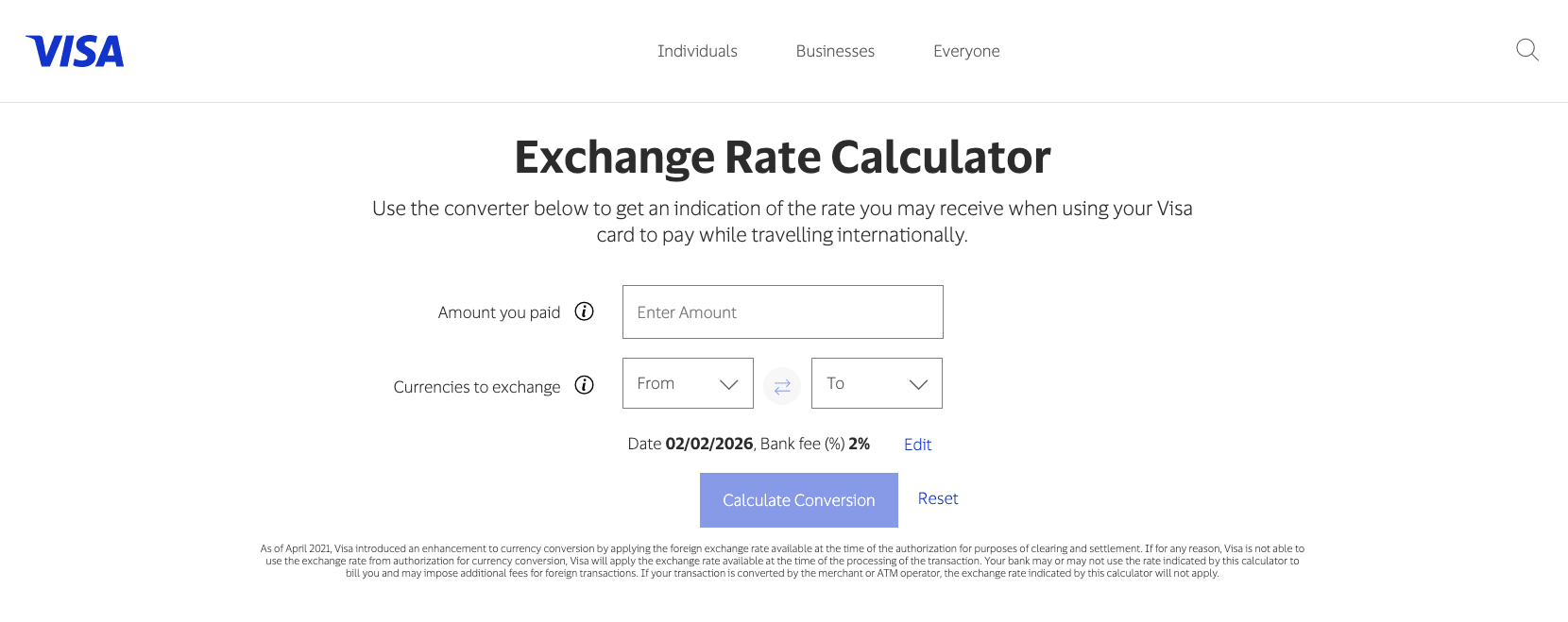

Visa foreign transaction fees calculator

Visa offers a foreign transaction fee calculator which shows the exchange rate used on any given payment date, and lets you see how much your payment should cost in CAD.

The calculator allows you to enter the amount you spent in the foreign currency, and the percentage foreign transaction fee your bank or card provider uses. You'll then be shown the final billing amount in CAD.

The calculator is set to show a 2% foreign transaction fee, but you can adjust this in the calculator if you need to.

Image above is taken from visa.ca website, on February 2nd, 2026.

Image above is taken from visa.ca website, on February 2nd, 2026.

Visa card alternatives for international travel

While using your bank card abroad may be convenient and secure, you might want an alternative if you're looking to cut down on foreign transaction fees and access the best possible currency exchange rates. Having a card on a different network from Visa - like Mastercard - can also be reassuring.

Here we've picked out some strong Visa alternatives for international travel, including the Wise debit card which lets you hold multiple currencies and spend with no foreign transaction fee.

We've also added in the Koho card which has some account plans with no foreign transaction fees, the Canada Post cash Passport as a prepaid card option, and the BMO Matercard debit card in case your priority is to have a card on a different network.

| Providers | Coverage | Foreign transaction fee | ATM fees |

|---|---|---|---|

| Wise Debit Card | Hold 40+ currencies, spend in 150+ countries | None | 2 withdrawals to 350 CAD/month with no Wise fee, then 1.5 CAD + 1.75% |

| Koho Mastercard Debit Card | Hold CAD, spend wherever Mastercard is accepted | 1.5% on Essential Plan, waived on other plans | Some plans offer no fee withdrawals |

| BMO Debit Mastercard | Hold CAD, spend wherever Mastercard is accepted | 2.5% | 1.5 CAD - 2 CAD |

| Canada Post Cash Passport Mastercard prepaid card | Add CAD, convert to one of 6 supported currencies | If you don't have the currency you need in your account there's a 3.25% foreign transaction fee | Variable fees by currency |

*Details correct at time of research - 3rd March 2025

Wise card

| 💡 Great for: Hold 40+ currencies, and spend in 150+ countries, with mid-market exchange rates |

Wise offers digital accounts which support 40+ currencies for holding and exchange. Once you have an account you can order your Wise card for free, and spend in 150+ countries, with mid-market exchange rates and low fees.

Cards are contactless and compatible with major digital wallets, allowing you to pay and manage your account with just your phone.

Wise accounts also offer account details to receive payments in 20+ currencies, which can be helpful if you're receiving money from overseas and don't want to convert incoming payments to CAD every time.

| Features | Wise pricing |

|---|---|

| Account & card fees | No ongoing fees, no card issue fee |

| Currency conversion | Mid-market exchange rates with low, transparent fees |

| Supported currencies | Hold 40+ currencies, get account details to receive payments in 20+ currencies |

| International ATM fees | 2 withdrawals to 350 CAD/month with no Wise fee, then 1.5 CAD + 1.75% |

| International transaction limits | Spend 55,000 CAD a month, withdraw up to 7,000 CAD |

*Details correct at time of research - 3rd March 2025

Check out this guide to get the best out of your Wise card abroad: How to use Wise card overseas

Koho card

| 💡 Great for: Several different account plans including some with no monthly fees, and others with ongoing charges and no foreign transaction fee |

Koho cards can be used globally and are issued through Mastercard. You can add CAD to your account and then spend anywhere the network is supported.

The Koho Essential plan has no monthly fee which can be attractive - but there is a foreign transaction fee with this account type of 1.5%. If you upgrade to a higher tier account you will pay up to 22 CAD a month in fees, but there are no foreign transaction fees to worry about.

Koho's varied account plans and cards can mean you're able to match the card to your normal spending needs, keeping fees as low as possible.

| Features | Koho pricing |

|---|---|

| Account & card fees | 0 CAD - 22 CAD/month account fees |

| Currency conversion | 1.5% foreign transaction fees on Essential Plan, waived on other plans |

| Supported currencies | Hold CAD, spend wherever Mastercard is accepted |

| International ATM fees | Some plans offer no fee withdrawals |

| International transaction limits | Spend up to 9,000 CAD daily, withdraw up to 1,510 CAD a day |

*Details correct at time of research - 3rd March 2025

More information on - Koho international fees.

BMO card

| 💡 Great for: Bank issued Mastercard debit card which can be linked to several different account plans |

BMO offers Mastercard debit cards which you can then link to the chequing account of your choice. Different account plans have their own fees, and while there are monthly charges in most cases, you may be able to waive these costs by maintaining a minimum balance in your account.

Having several cards, including some on different networks like Mastercard can be a good strategy when you're abroad. However, with BMO you pay a 2.5% foreign transaction fee for overseas spending so this may be better as a card for emergency use rather than daily payments.

| Features | BMO pricing |

|---|---|

| Account & card fees | 4 CAD - 30.95 CAD monthly fees deepening on the account you pick |

| Currency conversion | 2.5% foreign transaction fee |

| Supported currencies | Hold CAD, spend wherever Mastercard is accepted |

| International ATM fees | 1.5 CAD - 2 CAD |

| International transaction limits | Check the account terms and conditions for the specific plan you choose |

*Details correct at time of research - 3rd March 2025

Canada Post Cash Passport

| 💡 Great for: Prepaid travel card you can use to hold 6 currencies and spend overseas conveniently |

The Canada Post Cash Passport supports Canadian, US and Australian dollars, Euros, British pounds, Japanese yen, and Mexican peso. You pay a fee to get your card in the first place and can then add CAD balance and convert to the currency you need for spending. There's no fee to spend a foreign currency you hold in your account. However, if you don't have the currency you need in your account there's a 3.25% foreign transaction fee.

Bear in mind that Canada Post's exchange rate may include fees which you pay when converting your currencies. Compare your options and check the rates before you convert.

| Features | Canada Post Cash Passport pricing |

|---|---|

| Account & card fees | 15 CAD card purchase fee |

| Currency conversion | Canada Post's exchange rate may include fees which you pay when converting your currencies - if you don't have the currency you need in your account there's a 3.25% foreign transaction fee |

| Supported currencies | Add CAD, convert to one of 6 supported currencies |

| International ATM fees | Variable fees by currency |

| International transaction limits | Withdraw up to 960 CAD a day, and spend up to 4,000 CAD daily |

*Details correct at time of research - 3rd March 2025

Visa international ATM fees

ATM cash withdrawal fees apply when you want to withdraw money from your account when you are abroad. If you are using a provider which only supports holding CAD in your account, you'll also often pay a foreign transaction fee when you make a cash withdrawal overseas.

As with other fees, the Visa international ATM fees which apply are decided by the bank or provider which issues the card - this means the costs can vary a lot.

Here's a reminder of the providers we looked at earlier, including Visa cards from Scotiabank and CIBC, and alternatives from Wise and Koho.

| Provider | Foreign transaction fee | ATM fee |

|---|---|---|

| ScotiaCard Visa debit card | No foreign transaction fee | 3 CAD - 7.5 CAD depending on the location and the ATM operator |

| CIBC Advantage Debit Card | 2.5% | 2 CAD - 5 CAD depending on the location and the ATM operator |

| Wise Debit Card | None | 2 withdrawals to 350 CAD/month with no Wise fee, then 1.5 CAD + 1.75% |

| Koho Mastercard Debit Card | 1.5% on Essential Plan, waived on other plans | Some plans offer no fee withdrawals |

| Canada Post Cash Passport Mastercard prepaid card | If you don't have the currency you need in your account there's a 3.25% foreign transaction fee | Variable fees by currency |

*Details correct at time of research - 3rd March 2025

Visa foreign transaction limits

When you use a card overseas you'll need to check the limits which apply, including daily or monthly spending limits and ATM withdrawal limits. These can vary a lot depending on the bank which issued your Visa card - but knowing in advance can help you to avoid embarrassing situations during your trip.

How can I avoid foreign transaction fees on a Visa card?

Here are some pointers to help you avoid foreign transaction fees on a Visa card:

Check your card provider's terms and conditions before you travel, to be clear on the fees which apply

Consider getting a specialist travel card linked to a multi-currency account from a provider like Wise so you can spend freely in foreign currencies

Look out for cards with no foreign transaction fees - Wise doesn't charge you to spend a currency you have, for example and Koho waives foreign transaction fees on some account plans

Always pay in the local currency wherever you are - choosing to spend in CAD will mean paying more in the end

Conclusion: Are Visa cards good for travel?

Visa is a globally accepted payment network which means it is a good choice for travel. However, different Visa cards have their own fees for overseas use. Picking your card carefully can help you to limit the fees you pay. Look out for foreign transaction fees and overseas ATM fees which can end up being very expensive for some cards.

Having a specialist travel card can be a smart move. You'll be able to choose from a provider like Wise which lets you hold money in many currencies conveniently for free spending overseas. Or you may choose a card from Koho which has a monthly fee and no foreign transaction fees when you travel. Use this guide to compare a few options and select the right one for your needs.

Visa international fees FAQs

How to let Visa know you are travelling?

Look at your bank or card provider's website or app to check if you need to let them know you're planning an overseas trip. This will help to make sure your card is not blocked due to unusual activity while you're away.

How do I know if I have to pay foreign transaction fees with Visa?

Check your card provider's terms and conditions before you travel, to be clear on the fees which apply. In particular, look out for foreign transaction fees and overseas ATM fees which can end up being very expensive for some cards.

Related article - Best Canadian cards without foreign transaction fees